Equipped with extensive experience and expertise, Ram Riojas, President and CEO of Delta Defense Group, LLC, provides us with valuable insights into the North American space and intelligence sectors.

AN EXPERT IN SPACE AND INTELLIGENCE

The career background of Ram Riojas, President and CEO of Delta Defense Group, LLC (Delta), includes almost three decades in the defense, aerospace, and intelligence sectors.

Riojas spent 26 years on military active duty in the US Air Force (USAF) and US Intelligence Community, starting in 1995 as a second lieutenant and concluding in 2022 when he retired as a colonel, and for the past three years has worked as a global defense consultant and advisor.

In terms of the space sector, Riojas’ expertise comes from civilian education, military training, and the execution of space operations.

On the civilian education side, he studied aerospace engineering as an undergraduate at the University of Texas and received a master’s degree in aeronautical science from Embry-Riddle Aeronautical University in Daytona Beach, Florida.

Riojas has also completed military training and certifications across every space, intelligence, and nuclear missile operations discipline in the USAF, including missile warning, space surveillance, space launch, command and control, intelligence (signals, imagery, and human), and intercontinental ballistic missile operations.

Eventually, Riojas was able to leverage his academic background and tactical operational expertise to become a strategic-level space and intelligence expert.

Today, he stays engaged in every aspect of these industries in order to conduct global defense consulting engagements and support a variety of customers across government and the private sector.

Equipped with extensive experience and expertise, Riojas offers his informed perspective on space and intelligence in North America.

Q&A WITH RAM RIOJAS, PRESIDENT AND CEO, DELTA DEFENSE GROUP, LLC

What is your current take on the space and intelligence sectors in North America?

Ram Riojas, President and CEO (RR): At the moment, the space and intelligence sectors in North America are rapidly growing in capability and capacity and greatly influencing every other industry.

This trend has been ongoing for the past several years and is primarily enabled by advancements in technology, reduced space launch costs, and private sector investment in R&D.

This is an extremely exciting time, like the space race, with tremendous interest from the worldwide public. The major difference in this era is that these new advancements are truly part of our everyday life, such as the internet, GPS navigation, banking, e-commerce, logistics, healthcare, and mobile communications.

This is not without challenges though, including the management of incredibly powerful technology such as remote sensing/surveillance from space and the preservation of public privacy and freedoms, while legislation and regulation are also struggling to keep up with technology advancements.

Additionally, there will be a point in time when the space and intelligence markets become saturated with providers and technology advancements reach their limit, so it will be interesting to see what happens to the plethora of new and legacy companies in business today.

“Every person with a smartphone or internet access today has infinite power, only limited by their imagination, talent, and ambition”

Ram Riojas, President and CEO, Delta Defense Group, LLC

Can you tell us more about the new space economy?

RR: Worldwide, the space economy is valued at approximately $600 billion per year and is projected to triple in the next decade. These figures may be low since they only account for the first-order effects and impacts of space-related activities such as satellite and rocket manufacturing, defense and intelligence space systems, space tourism, and satellite communications (SATCOM).

In addition to these, the second and third-order effects on other areas of the economy that are enabled by space capabilities are even larger. For example, financial transactions across all sectors are dependent on space-based technology such as GPS and SATCOM.

Healthcare, agriculture, oil and gas, and academia likewise rely on space capabilities for day-to-day operations including data storage, computation, analysis, and transmission.

Internet technology also enables every aspect of the global economy and has allowed human talent to be leveraged from all over the world in a seamless fashion.

What about the growth of intelligence, surveillance, and reconnaissance (ISR)?

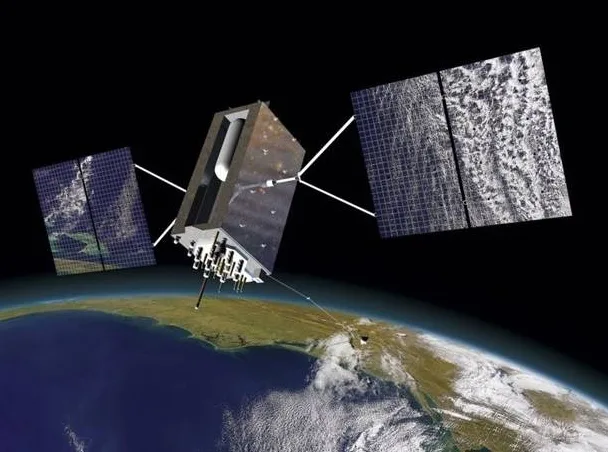

RR: There is significant growth in this area, especially in commercial space-based synthetic aperture radar (SAR) and commercial radio frequency (RF) monitoring, detection, and geolocation.

Other areas such as traditional electro-optical imagery have also improved in terms of resolution and latency, but those have been available commercially for decades. In contrast, SAR and RF sensing from space was exclusively reserved for government use and gave advanced nations a tremendous edge when conducting ISR and military operations.

SAR uses radar technology instead of typical optical sensors like most digital cameras. The advantage of this is the ability to image objects on Earth in any light or weather condition, and it can also see through camouflage and concealment.

RF space sensing technology helps map any human, machine, or radar activity on the ground, in the air, or at sea, which helps establish patterns of life and enables change detection analysis.

Commercial companies leading the charge in SAR and RF ISR from space offer significant value for their services and are being embraced by the US government to augment existing capabilities and reduce spending.

Can you provide some insights into the major shift in the traditional market share of the space sector?

RR: Historically, the space sector’s market share has been 80 percent government and 20 percent commercial. Today, it’s 80 percent commercial and 20 percent government.

The commercial sector’s increased market share has primarily been driven by user equipment availability, faster internet speeds, and increased mobile bandwidth.

Commercial consumers can now ingest and use most space-based services during their daily life. This was not possible years ago, so naturally the main consumer of space-based services was the government sector.

However, the government’s market share has decreased as it has decided to leverage the commercial sector and avoid the need to develop technology from scratch, added to the fact that most commercial space services are dual-use technologies.

This allows the government to focus on areas not being developed commercially for civilians. There are also newer policies and legislation in place in the US that direct federal agencies to leverage commercially available technologies before creating a new government-funded program.

How will the growth of the commercial space and intelligence sectors benefit North America, as well as other parts of the world?

RR: The growth of the North American commercial space and intelligence sectors will help expand commerce across all other fields and geographic areas throughout the world.

As most space and intelligence capabilities are dual-use, the private sector continues to invest resources into R&D, marketing, and manufacturing because they are confident that their systems and services can be used by both the government and commercial customers.

There will be a direct economic impact on jobs and services related to space activities, and more remote areas and underserved communities will be connected to national and global economies. There are secondary benefits for the rest of the world when the North American economy is strong, since it is one of the largest consumer markets globally.

It will also increase affordability for employees as they can work remotely and live in areas with a lower cost of living while supporting high-cost hubs of commerce, finance, and technology.

Additionally, it will enable the ability to recruit a wide variety of talent without geographic limitations, conduct business meetings and transactions remotely, and maximize crop yields by better managing agriculture based on the latest climate shifts.

“The growth of the North American commercial space and intelligence sectors will help expand commerce across all other fields and geographic areas throughout the world”

Ram Riojas, President and CEO, Delta Defense Group, LLC

Looking ahead, how do you see the space and intelligence sectors developing over the next five to 10 years?

RR: There will be rapid growth in the next five years. Every aspect of these sectors is expanding at a fast pace, and currently what we are seeing is the growth of infrastructure and technology.

The next related aspect that has not started to rapidly grow yet is the consumer sector. We have barely scratched the surface of what the consumer will be able to do with all these new space and intelligence capabilities and capacity.

That portion of the market will be five to 10 times larger than the actual space and intelligence systems themselves. The possibilities are endless in terms of consumer communications, financial activities, commerce, healthcare, travel, etc.

Remember how much the global economy grew with the advent of the fixed-site terrestrial internet in the late 1990s and early 2000s? Now, fast-forward to today and imagine the power of exponentially faster internet at the consumer’s fingertips on their smart mobile devices while on the go.

Every person with a smartphone or internet access today has infinite power, only limited by their imagination, talent, and ambition.

Smartphones and 5G technology have provided a glimpse of how much commerce can grow, so having high-speed broadband internet and cloud computing anywhere on the globe on a mobile device will boost commerce across every field – a new era of consumerism that will exceed what we have seen with Amazon or eBay.

In the next 10 years, there will continue to be growth, likely 10 to 15 percent per year, as technology advancements slow down a bit and the industry finds its footing in terms of size and services.

This all assumes a steady state of world affairs in terms of defense, security, and economic stability. Therefore, any major change in military operations, large conflicts, economic sanctions/tariffs, or another global pandemic of sorts could alter these assessments, but technology advancements have always prevailed and are difficult to stop.